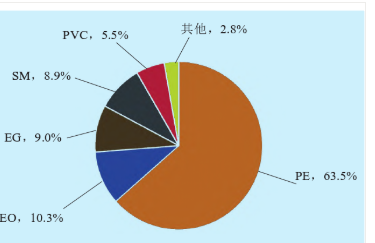

The ethylene industry in China has gradually entered the mature period, the downstream derivatives mainly PE, ethylene oxide (EO), EG, SM, polyvinyl chloride (PVC) and other products. In 2020, the five categories of products accounted for about 97.2% of the total ethylene consumption. Among them, the largest consumption sector is PE, accounting for 63.5 percent of the total consumption. This was followed by EO and EG, which accounted for 10.3% and 9.0% respectively (see Figure 2).

1 | PE development trend: homogeneity competition is intense, the differentiation, the high-end development

PE main products are linear low density polyethylene (LLDPE), low density polyethylene (LDPE), high density polyethylene (HDPE) three categories. PE has the advantages of low cost and good chemical properties, and is widely used in agriculture, industry and daily life. From 2016 to 2021, the domestic PE production capacity continued to expand, with an average growth rate of 12%, with a total production capacity of 27.73 million tons/year in 2021.

At present, PE products in China mainly rely on low-end general materials, and high-end PE products rely heavily on imports, and there are obvious structural problems, namely surplus of low-end products and lack of high-end products. In the next few years, with the continuous expansion of domestic PE production capacity, the homogeneous competition will be more fierce, and the domestic replacement of high-end products is huge. Taking metallocene polyethylene (mPE) products as an example, at present the domestic market demand is about 1 million tons/year, and China’s production in 2020 is only about 110,000 tons. The huge supply gap stimulates a large number of imported mPE products to enter the Chinese market. Therefore, it is of great practical significance for PE to develop in the direction of high-end and differentiation.

2 | EO development trend of integration and EO/EG flexible switching

EO is mainly used in the production of EG, and most enterprises adopt EO/EG co-production device. In addition, EO can also be used in water reducing agent, polyether, disinfection and sterilization fields.

In recent years, with the gradual contraction of EG market profits, most EO/EG co-production units began to shift to the production of EO, and take into account the flexible output of both, so as to improve economic benefits. EO production capacity has increased significantly, but the development of downstream products has entered a bottleneck period, and the phenomenon of uniformity and homogeneity is obvious. The main products, such as polycarboxylic acid water reducing agent monomer, surfactant and ethanolamine, have been facing the situation of overcapacity, industry competition is fierce, capacity utilization rate is reduced. To this, through the integration of upstream and downstream development model, will be more conducive to enhance the core competitiveness of enterprises, such as ethylene, EO, EG, build to polyether monomer (such as polyethylene glycol monomethyl ether, allyl polyoxyethylene ether, methyl allyl polyoxyethylene ether), polyoxyethylene nonionic surfactants (such as fatty alcohol polyoxyethylene ether) and complete industrial chain, Continue to expand downstream, rich product categories.

3 | EG: extending the industrial chain, product cross production layout

EG is the second largest application field of ethylene. From 2016 to 2021, with the production of several large coal-chemical projects and integrated refining and chemical projects, EG production capacity increased year by year, with a total production capacity of 21.452 million tons/year in 2021.

In recent years, EG capacity has continued to grow, but downstream demand has slowed, overcapacity will become more obvious. From the perspective of consumption end, our EG is mainly used to produce polyester, accounting for EG consumption structure of more than 90%, the consumption field is relatively single, there is a short downstream industry chain, product structure is similar, low price competition serious problems.

In the future, we should increase the application and development of unsaturated polyester resin, lubricating oil, plasticizer, non-ionic surfactant, coating, ink and other industries through the extension of the industrial chain, gradually change the situation of single use, form an industrial chain from production to application, improve the added value of products, in order to reduce market risks.

4 | SM trends: a significant expansion capacity, stability of the downstream industry

The downstream of SM is mainly used for the production of styrene polymers and various ionic polymers, such as combustible polystyrene (EPS), polystyrene (PS), acrylonitrile-butadiene-styrene terpolymer (ABS), unsaturated polyester resin (UPR), styrene rubber (SBR), styrene copolymer (SBC) and other products. Among them, EPS, PS and ABS account for more than 70% of SM consumption in China, and their products are mostly used in home appliances, electronic equipment, automobiles, real estate and other industries.

In recent years, with the production of large-scale downstream supporting SM units for refining and chemical integration in China and the surge of propylene oxide/styrene monomer (PO/SM) co-production projects, SM production capacity has shown a continuous growth trend. From 2020 to 2022, SM’s production capacity has witnessed rapid growth, and it is expected that by the end of 2022, the production capacity will exceed 20 million tons/year. With the continued release of capacity, the pattern of domestic supply and demand has seen a marked shift, with imports falling sharply and a small amount of net exports. As the new production capacity of SM is greater than that of pure benzene in 2021, raw material pure benzene is in the situation of short supply, which further compresses the production profit of SM. From the perspective of consumption, among the three downstream markets, only the ABS industry maintains a high operating rate, which makes it difficult to digest the supply increment brought by SM’s new production capacity. As a result, SM is affected by the contradiction between supply and demand and cost support, and the market situation shows a range-oscillating trend. In the end market, the “home economy” caused by the COVID-19 pandemic has boosted the sales of small home appliances. At the same time, the epidemic situation is still severe abroad, and the export of epidemic prevention products and some household appliances exceeds the expectation, which has driven the demand growth of SM industry chain and improved the profitability significantly.

5 | PVC development trend: quality and environmental protection go hand in hand

PVC is the first universal synthetic resin material in our country. With its outstanding performance and price ratio, it is widely used in industrial and daily life products, with excellent wear resistance, flame retardant, chemical corrosion resistance and electrical insulation characteristics. PVC production mainly has two kinds of preparation process, one is calcium carbide method, the main production raw materials are calcium carbide, coal and raw salt. In China, limited by resource endowment of rich coal, lean oil and little gas, calcium carbide method is the main method. In the production process, a large amount of fresh water resources are consumed, and there are bottlenecks such as high energy consumption and pollution. Second, ethylene process, the main raw material is petroleum. The international market is mainly ethylene process, with excellent product quality, advanced technology, more environmental protection, etc., has the potential to replace calcium carbide process in the future.

China is the world’s largest producer of PVC, but also a major consumer, the domestic market is in a state of overcapacity. In the current global implementation of plastic instead of steel, plastic instead of wood strategy, reduce the consumption of mineral resources and wood under the background, PVC resin has achieved great development, downstream application market continues to expand, in plastic profiles, medical blood transfusion tubes, blood transfusion bags, automobiles, foaming materials and other product fields are widely used. With the acceleration of China’s urbanization process and the improvement of residents’ living conditions, the expectations and requirements of the society for environmental protection have been constantly raised. The downstream of the PVC industry has entered a stage of fierce competition between quality and environmental protection, and the application field has been continuously broadened and the trend of diversified development is obvious.

6 | other product development |

Other ethylene downstream products, such as ethylene – vinyl acetate, polyvinyl alcohol, vinyl acetate copolymer (EVA), ethylene – vinyl alcohol copolymer and ethylene – acrylic acid copolymer, epdm, etc., the current account for the relatively small, the application prospect of relatively stable, the current application sharply expand prospect can’t see, also can’t see is replaced by a large number of threats. Domestic high-end polyolefin products are generally limited by foreign technical barriers, such as ethylene-α-olefin (1-butene, 1-hexene, 1-octene, etc.) copolymer, domestic technology is not mature, there is a large space for development. Most downstream products of ethylene are in line with the direction of social and economic development and the needs of consumption upgrading. For example, under the background of carbon peak and carbon neutrality, the photovoltaic industry enters a fast development lane, the demand for EVA photovoltaic materials will increase at a high speed, and the market price of ethylene acetate will continue to run at a high level.

It is expected that by 2025, China’s ethylene production capacity will exceed 70 million tons/year, which will basically meet the domestic demand, and there may even be surplus. Under the influence of the national “double control” policy on energy consumption, the coal chemical industry and petrochemical industry will face a severe test during the 14th Five-Year Plan period, which will cause great uncertainty to the ethylene project using fossil resources as raw materials. In the context of carbon peaking and carbon neutrality, enterprises are advised to fully consider the reduction and substitution of carbon emissions when planning such projects, replace fossil energy with renewable energy and clean electricity, actively eliminate backward production capacity and reduce excess capacity, and promote industrial transformation and upgrading.

Ethylene and hydrogen produced by the project of ethane cracking to ethylene are important raw materials required by the domestic market, with great development prospects and strong profitability. Heavily dependent on imports, domestic ethane resources, however, there is a single raw material sources, supply chain facilities dedicated, ocean transportation difficulties, such as “their” risk, suggest the National Development and Reform Commission and other industry departments to strengthen planning guidance, the enterprise combining with their own actual situation, carry out project feasibility, avoid “set, dispersed in a hubbub” speculation.

Ethylene downstream especially high-end derivatives, will usher in a huge market space. Such as mPE, ethylene-α-olefin copolymer, ultra-high molecular weight polyethylene, high carbon alcohol, cyclic olefin polymer and other products will be the focus of the market. In the future, new projects such as refining and chemical integration, CTO/MTO, and ethane cracking will provide sufficient ethylene raw materials to accelerate the development of ethylene downstream industry to the direction of “differentiation, high-end and functional”.

Post time: Aug-03-2022